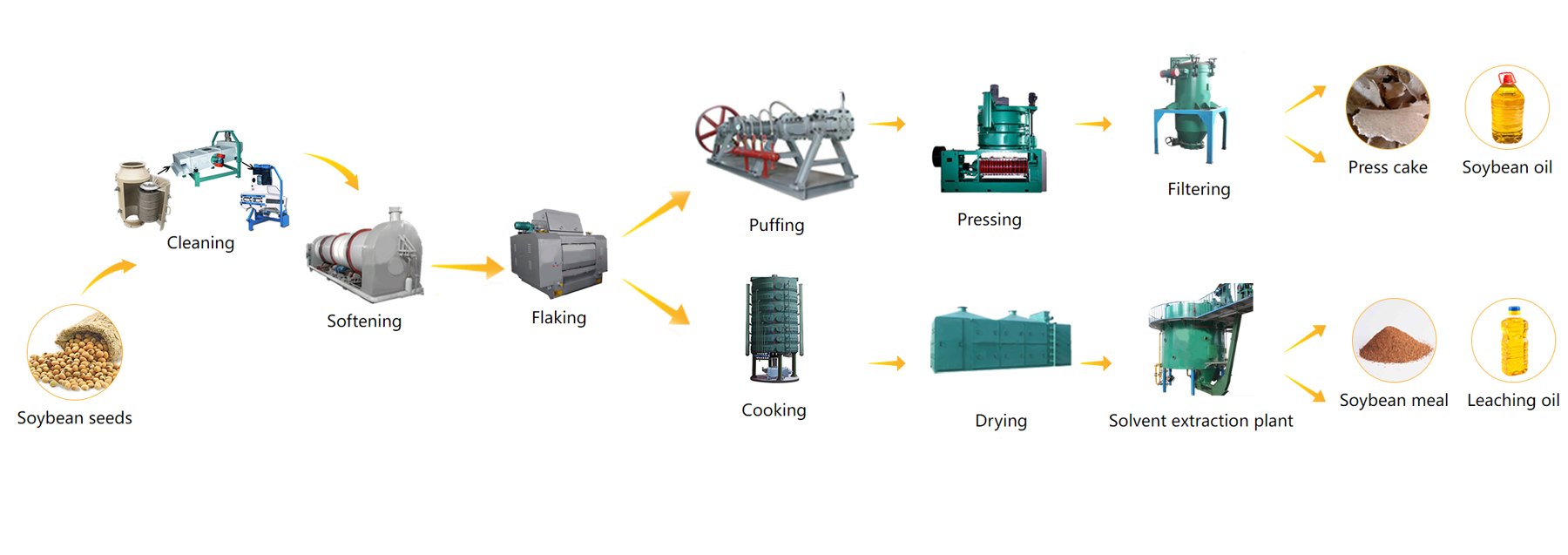

Soybean oil is extracted from mature soybean seeds, which typically contain 18–22% oil content. Unlike oils with strong aromatic profiles (e.g., olive oil), its mild taste makes it a staple in both traditional and modern diets. Nutritionally, it meets global food standards, with refinements processes removing impurities while preserving key nutrients. Commercially, it is categorized by extraction method: pressing (preferred for small-to-medium plants due to lower upfront costs and perceived “natural” appeal) and solvent leaching (adopted by large-scale facilities for higher yield, as it reduces residual oil in meal to 1–2%). This flexibility in processing makes soybean oil production adaptable to various investment scales, a key advantage for entering the South African market.

Raw soybeans contain impurities (stones, dust, metal) and require preparation to maximize oil yield:

Cleaning: Vibrating screens remove large debris, while Gravity stone remover separate stones by density, and permanent magnet drums capture metal fragments.

Crushing & Softening: Soybeans are crushed into 4–6mm pieces, then heated in softening pots (60–70°C) to adjust moisture content to 12–14%.

Rolling: A Flaking mill flattens crushed soybeans into thin flakes (0.3–0.5mm) to rupture oil cells, enabling easier extraction.

Pressing (Small-to-Medium Plants): Flakes are fed into screw,where rotating screws apply pressure to squeeze out soybean oil. Crude oil (with 20–30% impurities) is collected, while pressed cake is stored for meal processing.

Solvent Extraction (Large Plants): Use the principle of solvent and oil dissolution to extract soybean oil from soybean cake. Solvent extraction of soybean oil mainly includes four processes: solvent extraction, miscella evaporation and stripping, wet meal desolvation and solvent recovery. Next, let’s take a look at the detailed process of soybean oil extraction. (Related post: 100TPD Soybean Oil Solvent Extraction Plant >>)

Oil extraction section: Use solvent (n-hexane) to extract the oil from soybeans, and then get two kinds of products. One is wet meal with solvent, the other is mixed oil (solvent and soybean oil).

Desolventization section (DTDC System): The main equipment, desolventizing-toasting-drying-cooling tower will separate the solvent from wet meal. Then the meal can be packed to sell as animal feed.

Mixed oil stripping and steaming section: Through 1st evaporator, 2nd evaporator and stripping tower, the mixed oil can be separated into two parts. Solvent will be sent into the last section to recycle.

Solvent recycling section: Through cooling, recycle the solvent into solvent turnover tank.

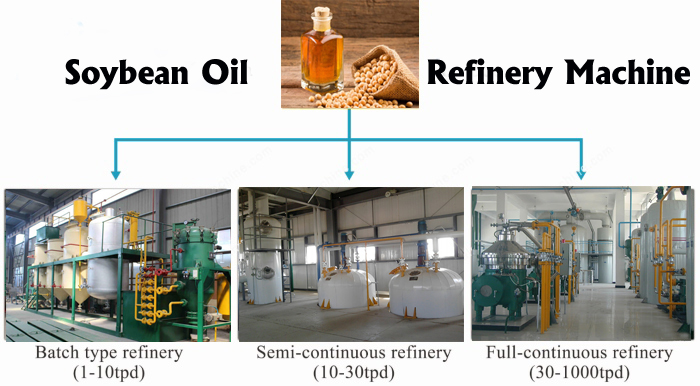

Crude oil requires purification to remove gums, free fatty acids, and pigments:

Degumming: Water is added to hydrate phospholipids (gums), which are separated via centrifugation.

Neutralization: Caustic soda is used to remove free fatty acids, forming soapstock that is skimmed off.

Bleaching: Activated clay or carbon adsorbs pigments (e.g., chlorophyll) under vacuum.

Deodorization: High heat (220–250°C) under vacuum removes volatile compounds, eliminating off-flavors.

Dewaxing (Optional): For premium oils, cold filtration removes waxes to prevent clouding at low temperatures.

Vibrating cleaning screen: Removes impurities (capacity: 1–50 TPH).

Gravity stone remover: Separates stones (efficiency: 95%+).

Flaking mill: Produces uniform flakes (output: 5–30 TPH).

Steaming and frying pan: Adjusts moisture and temperature (heating source: steam or fuel).

Permanent magnet drum: Captures metal contaminants.

Screw Oil Press: Core pressing unit (capacity: 0.5–20 TPH; residual oil: 5–8%).

Filter press: Removes solids from pressed crude oil.

Closed extractor (e.g., rotary or loop type): Mixes flakes with hexane (capacity: 20–100 TPH).

Desolventizing-toasting machine: Removes hexane from spent flakes.

Evaporators (1st & 2nd stage) + stripper: Recovers hexane from mixed oil and produces crude oil.

Degumming tank + centrifuge: Separates gums.

Neutralization tank: Reacts with caustic soda.

Bleaching tower: Holds adsorbents for pigment removal.

Deodorization tower: Removes volatile compounds.

Vacuum pump: Maintains low pressure in refining stages.

Heat exchanger: Regulates temperature efficiently.

Automated Filling equipment: Fills containers (speed: 50–500 bottles/hour).

Conveyors: Transports raw materials and finished products.

Storage tanks: Holds raw soybeans, crude oil, and refined oil (material: food-grade stainless steel).

Boiler: Supplies steam for heating and refining.

Wastewater treatment system: Ensures compliance with South African environmental laws.

South Africa’s soybean oil market offers a profitable landscape for entrepreneurs willing to navigate regulatory requirements and leverage regional demand. By aligning plant scale with market needs, adopting efficient processing technologies, and building local partnerships, you can establish a sustainable business that serves both domestic and export markets. With the right planning—from feasibility studies to post-launch optimization—a soybean oil production plant in South Africa can deliver consistent returns while contributing to the country’s agricultural value chain.

For tailored support—including equipment sourcing, process design, or market entry strategies—partner with experienced suppliers who understand South Africa’s unique business environment. (Read more: Establish A Small Scale Soybean Oil Production Line)

The main soybean oil mill plant in south africa to process soybean oil covers many steps.

Step 1: Strategic Planning

Market & Feasibility Research: Analyze local demand (e.g., retail vs. industrial buyers), competitor capacity, and raw material availability. South Africa’s soybean production is concentrated in Mpumalanga and Free State, so proximity to these regions reduces transport costs.

Business Plan Development: Outline production scale, financial projections, and risk mitigation (e.g., currency fluctuations, supply shortages). Include a section on accessing government incentives—such as tax breaks for agribusinesses in designated economic zones.

Step 2: Regulatory & Operational Preparation

Secure Funding: Source capital through local banks, international investors, or grants for agricultural projects. Budget for land, equipment, and working capital (average startup costs for a mid-scale plant exceed $200,000).

Location Selection: Prioritize areas with access to ports (Durban, Cape Town) for exports, reliable utilities (water, electricity), and affordable labor. Coastal regions offer logistical advantages for both raw material imports and finished product distribution.

Licensing & Compliance: Obtain a business registration certificate from the Companies and Intellectual Property Commission (CIPC), environmental approval (EIA) from the Department of Forestry, Fisheries and the Environment, and tax registration (VAT, income tax) from SARS. Note that South Africa enforces strict transfer pricing rules for foreign-owned firms.

Step 3: Infrastructure & Setup

Plant Design & Construction: Hire local engineers to design layouts optimized for process flow (e.g., separating noisy pretreatment areas from refining). Conduct geological surveys to ensure structural safety, especially in flood-prone regions.

Supplier Partnerships: Negotiate long-term contracts with soybean farmers or importers (e.g., from Brazil, Argentina) to secure consistent supply. Partner with local maintenance firms for equipment upkeep.

Step 4: Launch & Operations

Equipment Installation & Staff Training: Work with equipment suppliers to install lines and train local staff on safety protocols (e.g., handling solvents in leaching processes). Collaborate with vocational schools for customized training programs.

Trial production & Optimization: Conduct trial runs to test yield and quality, adjusting parameters (e.g., steam temperature in refining) before full-scale production. Implement quality control systems to meet South Africa’s SANS 1186 edible oil standards.

Plant capacity is determined by raw material availability, market demand, and investment budget.

Common scales in South Africa include:

Small-Scale Soybean Oil Processing Plant(5–50 TPD): Ideal for local markets or rural areas. Uses batch pressing equipment with minimal automation. Requires 500–1,000 m² of land and employs 10–20 staff. Annual revenue ranges from 500,000 to3 million, with lower operating costs but higher residual oil rates (5–8% in meal).

Medium-Scale Soybean Oil Processing Plant(50–200 TPD): Balances automation and cost-efficiency. Combines continuous pressing with basic refining. Serves regional distributors and small food manufacturers. Needs 1,000–3,000 m² of land, 20–50 staff, and generates $3–15 million in annual revenue.

Large-Scale Soybean Oil Processing Plant(200+ TPD): Adopts solvent leaching and fully automated refining. Supplies national retail chains and exports to Southern Africa. Requires 5,000+ m² of land, 50+ staff, and investments exceeding 1million.Annual revenue can surpass 50 million, with residual oil rates below 2%.

Capacity planning must also account for seasonal soybean harvests (South Africa’s harvest runs from March to May) by including on-site storage for 3–6 months of raw material.

South Africa’s soybean oil sector is a dynamic component of its agricultural processing industry, with both opportunities and evolving dynamics:

Market Performance

After peaking in 2022, the market experienced a modest downturn in 2023–2024, but consumption remains resilient due to population growth and urbanization. Production, valued at several hundred million dollars annually, follows a similar trajectory, with 2021 marking a period of exceptional growth (+X% year-over-year) before stabilizing. Critically, South Africa is a net exporter of soybean oil, with Zimbabwe, Zambia, and Mozambique absorbing X% of total shipments—leveraging its geographic position as a gateway to Southern Africa.

Key Trends

Regional Export Growth: Mozambique leads import growth among neighboring countries, with a compound annual growth rate (CAGR) of X% in shipment volume, reflecting expanding cross-border demand.

Sustainability Focus: South African regulators are tightening environmental standards for processing plants, pushing for water-efficient technologies and reduced emissions—a trend that aligns with global consumer preferences for eco-friendly products.

Value Chain Integration: Leading processors are integrating upstream (securing direct soybean supply from local farmers) and downstream (expanding into bottled retail products) to mitigate price volatility and boost margins.

Technology Adoption: Automation in refining and packaging is becoming a competitive differentiator, as large plants aim to reduce labor costs and improve consistency.