Soybean oil, derived from the seeds of the soybean plant (Glycine max), stands as one of the most widely consumed vegetable oils globally, celebrated for its versatility, nutritional profile, and affordability. It accounts for over 30% of the world’s total vegetable oil production, with major producers including the United States, Brazil, Argentina, and China.

Chemically, soybean oil is rich in unsaturated fatty acids—specifically, approximately 58% linoleic acid (an omega-6 polyunsaturated fatty acid) and 23% oleic acid (a monounsaturated fatty acid)—alongside essential fat-soluble vitamins such as vitamin E and vitamin K. Unlike some vegetable oils, it has a neutral flavor and high smoke point (around 230°C/446°F), making it suitable for diverse culinary applications, from frying and baking to salad dressings. Beyond cooking, soybean oil is also a key raw material in industries like biodiesel production, cosmetics, and food processing (e.g., as an emulsifier in margarine).

A soybean oil production line is an integrated system designed to convert raw soybeans into refined, edible oil through a series of standardized, automated processes. These lines are categorized by scale—small, medium, and large—each tailored to meet specific production goals, budget constraints, and market demands.

Regardless of scale, a typical production line consists of three core stages: pre-treatment of raw materials, oil extraction, and oil refining. Small-scale lines are often semi-automated, compact, and ideal for local markets or small businesses (e.g., rural cooperatives), while medium and large-scale lines are fully automated, feature advanced control systems, and are built for high-volume output to supply regional or global markets. Key design principles of modern lines include energy efficiency, waste reduction (e.g., repurposing soybean meal as animal feed), and compliance with food safety standards (e.g., ISO 22000).

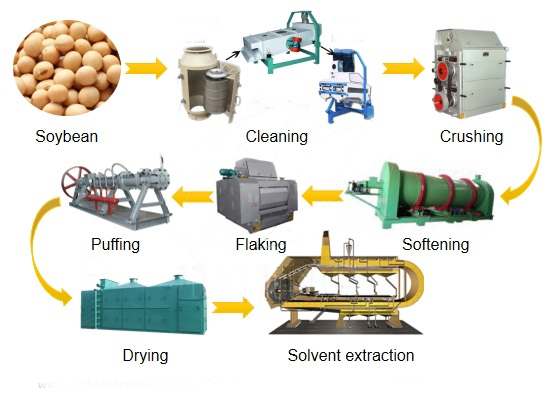

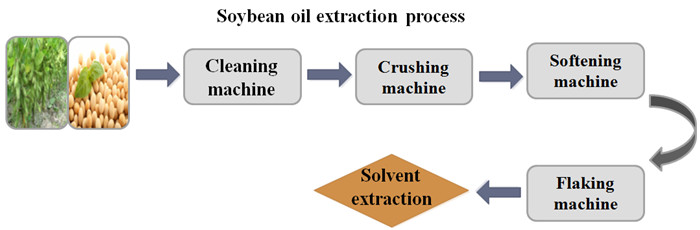

The production of soybean oil involves six sequential steps, each critical to ensuring oil quality, yield, and safety:

Raw soybeans often contain impurities like dirt, stones, metal fragments, and broken seeds, which can damage equipment and contaminate the final product. In this step, soybeans pass through vibrating screens to remove large debris, magnetic separators to extract metal particles, and destoners (which use air and gravity) to separate stones. After cleaning, soybeans are dried to a moisture content of 10–12% (optimal for processing) using rotary dryers or fluidized-bed dryers.

Soybean hulls (rich in fiber but low in oil) are removed to increase oil yield and reduce bitterness in the final product. Dehulling machines use mechanical friction to separate hulls from kernels, which are then crushed into small flakes (1–2 mm thick) using roller mills. Flaking increases the surface area of the soybeans, facilitating efficient oil extraction in subsequent steps.

The most common method for oil extraction in modern lines is solvent extraction (using food-grade hexane), which achieves an oil yield of 18–20% (compared to 10–12% for mechanical pressing alone). In this process:

Crude soybean oil contains impurities like phospholipids (gums), free fatty acids, pigments, and moisture, which can cause cloudiness, rancidity, or off-flavors. Degumming is the first refining step: crude oil is mixed with hot water (70–80°C) in a degumming tank, causing phospholipids to hydrate and precipitate. The mixture is then centrifuged to remove the gum (used in cosmetics or as a emulsifier).

Free fatty acids in crude oil are neutralized to improve stability and taste. A dilute solution of sodium hydroxide (NaOH, or lye) is added to the oil in a neutralization tank, reacting with free fatty acids to form soap stock (a byproduct used in soap making). The mixture is centrifuged to separate soap stock from the oil, which is then washed with hot water to remove residual soap.

Every stage of soybean oil production relies on specialized equipment, tailored to the scale of the line. Below is a complete list of essential machinery, organized by production step:

| Production Stage | Small-Scale Equipment | Medium/Large-Scale Equipment |

| Cleaning & Preparation | Manual screens, small magnetic separators, sun dryers | Vibrating screens, magnetic separators, destoners, automated dryers |

| Dehulling & Crushing | Manual dehullers, small roller mills | Automated dehulling machines, large roller mills (6–8 rollers) |

| Oil Extraction | Small hydraulic presses (yield ~12%), small solvent extractors | Large countercurrent extractors, multiple-effect evaporators, hexane recovery systems |

| Degumming | Small mixing tanks, manual centrifuges | Automated degumming tanks, high-speed disc centrifuges |

| Neutralization | Small neutralization tanks, manual washing | Large neutralization tanks, continuous centrifuges, water recycling systems |

| Bleaching & Deodorization | Small bleaching tanks, manual filters | Automated bleaching towers, vacuum filters, large deodorization columns (with steam injection) |

| Auxiliary Equipment | Small storage bins, manual conveyors | Automated conveyor belts (belt or screw type), bulk storage silos, quality control labs (with fatty acid analyzers, moisture meters) |

Key considerations for equipment selection include:

Costs include capital expenditure (CAPEX) (equipment, installation, facility) and operating expenditure (OPEX) (raw materials, labor, energy, maintenance).

The global soybean oil market is projected to grow at a CAGR of 4–5% from 2024 to 2030, driven by changing consumer preferences, industrial demand, and sustainability initiatives. Key trends include:

Rising Demand for Plant-Based Oils

As consumers shift toward healthier, plant-based diets (driven by concerns about cardiovascular health and animal product consumption), demand for soybean oil (a low-cost, nutrient-dense option) is increasing. In emerging markets (e.g., India, Southeast Asia), urbanization is boosting demand for processed foods (e.g., snacks, baked goods), which rely heavily on soybean oil as a cooking ingredient.

Growth in Biodiesel Production

Governments worldwide (e.g., the EU’s Renewable Energy Directive, the U.S. Renewable Fuel Standard) are mandating higher blending of biofuels with petroleum-based fuels to reduce carbon emissions. Soybean oil is a leading feedstock for biodiesel (accounting for ~25% of global biodiesel production), as it has a high energy density and can be blended with diesel without major engine modifications. This trend is expected to drive 30% of soybean oil demand growth by 2030.

Sustainability and Traceability

Consumers and retailers are increasingly demanding sustainable and traceable food products. Major brands (e.g., Unilever, Nestlé) are requiring soybean oil suppliers to adopt “zero-deforestation” practices (to address concerns about soybean cultivation driving Amazon deforestation) and implement blockchain-based traceability systems (to track soybeans from farm to factory). Certifications like the Roundtable on Responsible Soy (RTRS) are becoming a competitive advantage for producers.

Technological Innovation

Advancements in production technology are improving efficiency and reducing environmental impact:

Soybean oil offers numerous benefits for consumers, industries, and the economy, making it a staple in global markets:

Nutritional Benefits

Culinary Versatility

Economic Benefits

Soybean oil’s popularity stems from its nutritional value, culinary versatility, and economic viability, while its production process continues to evolve with technological advancements and sustainability goals. As the industry adapts to rising demand for plant-based products and biodiesel, and addresses challenges like deforestation and supply chain volatility, soybean oil is poised to remain a critical component of the global food and energy sectors for decades to come. For producers, choosing the right line scale (small, medium, or large) based on market demand and budget is key to success, while for consumers.